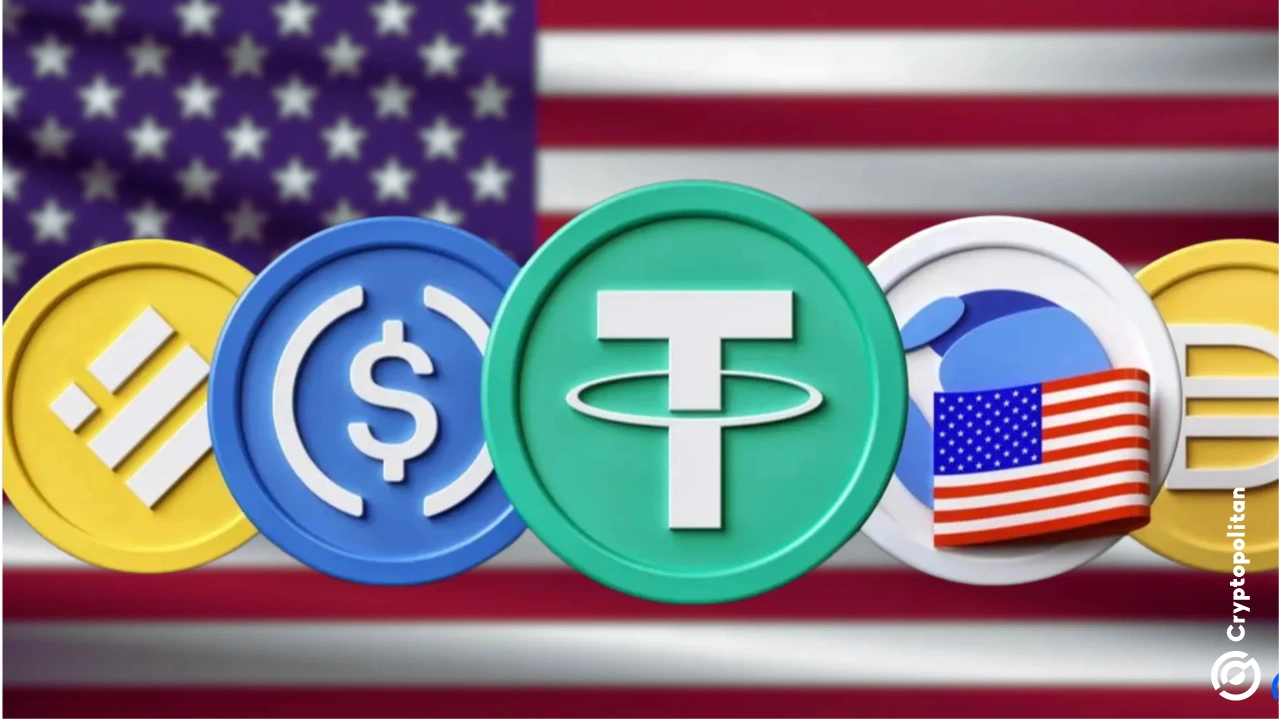

The future of money movement is not just APIs and open banking … it’s agentic finance

I just received an interesting report by Deloitte about API Banking and Banking-as-a-Service … the things I talked about back in the 2000s. The report is called the future of money movement, although I would argue it is the present of money movement along with embedded finance and open banking, which are also mentioned in…

Read More